Mortgage borrowing calculator self employed

Pay off your mortgage faster. The comparison rate for the ING Personal Loan is based on an unsecured loan of 30000 over a loan term of 5 years.

When Applying For A Mortgage When Self Employed A Major Factor Is To Declare As Much Income As You Mortgage Loan Originator Mortgage Interest Rates Home Loans

The mortgage amortization schedule shows how much in principal and interest is paid over time.

. 0345 602 7021 Hours. The output of each calculator is subject to the assumptions provided under each calculator which are also subject to change. If youre self-employed a lender will likely ask to see tax records You can ask for a mortgage pre-approval or a prequalification to see your loan options and real budget based on your.

For those who are self-employed you must provide additional documentation such as. How much is stamp duty in your state. Six ways to pay off your mortgage early.

Calls from the UK are free. The key to maximising your mortgage borrowing power is finding a lender that takes a common-sense approach to your spending. This is called your borrowing power.

Home Loan Calculators Try our easy to use home loan calculators to work out your borrowing power repayments buying and selling costs and loan comparisons. Mortgage refinancing is when a homeowner takes out another loan to pay offand replacetheir original mortgage. Since the year 2000 FHA loan rates were usually 0125 to 025 higher than conventional loans.

The mortgage calculator from Lloyds Bank can help you compare mortgages understand how much you could borrow and what your mortgage repayments would be. Include the last 24 months of filed tax returns for your entire household. With expert advice and options we can arrange a loan for you through main banks such as ANZ Westpac TSB ASB BNZ and other non-bank providers such as Bluestone Mortgages and First Mortgage Trust.

This calculator estimates your monthly principal and interest or interest only loan repayments but does not include monthly or annual service fees. But except for the years following the late 2000s financial crisis 2010 2015 for a couple of years FHA loan rates were lower than conventional. Work out if youll save money by switching to another mortgage.

Continuing with the above example the revised mortgage amount would be 260000 8060 268060. Equity Release Mortgages Equity Release Mortgages Hassle free mortgages. Your loan officer may require more information or less depending on the application process.

An Equity Release Mortgage may be a solution if you are over age 55 and looking to unlock some of the value of your home. With an interest only mortgage you are not actually paying off any of the loan. Our borrowing power calculator gives you an initial estimate of what a lender may be willing to lend to you.

Provides graphed results along with monthly and yearly amortisation tables showing the capital and interest amounts paid each year. This comparison rate applies only to the example or examples given. Using a mortgage broker.

See how those payments break down over your loan term with our amortization calculator. Provide the last 24 months of W-2 or W-9 forms any self-employment tax forms and documentation your current pay stubs and your bank records if you are self-employed. Use our comprehensive online mortgage calculator which shows the monthly interest only and repayment amounts on a mortgage.

This is a handy step to take before you contact your mortgage broker so that you can see the effect different interest rates and loan periods will have on the amount of money you can borrow the total interest you pay and your estimated. We work for you by finding the best borrowing solution available for your circumstances. Sat Sun and bank holidays.

First time buyer mortgages. A mortgage calculator can help borrowers estimate their monthly mortgage payments based on the purchase price down payment interest rate and other monthly homeowner expenses. At the end of the mortgage term the original loan will still need to be paid back.

Over the years FHA mortgage rates have generally been higher than conventional mortgage rates. Find out using our self employed income calculator. Were committed to providing you with a quality service so calls may be recorded or monitored for training purposes and to help us develop our services.

Existing customer PPI information. This is how much you would need to borrow from your lender in order to purchase your home. Different amounts and terms will result in different comparison rates.

The mortgage should be fully paid off by the end of the full mortgage term. 2 min read. A mortgage refinance calculator can help borrowers estimate their new monthly.

With a capital and interest option you pay off the loan as well as the interest on it. Think of it as a maximum borrowing power calculator helping you work out what a bank takes into consideration to ensure you could repay your home loan and meet your other outgoings. Calculate stamp duty for NSW ACT QLD VIC WA SA TAS.

Instead your mortgage default insurance premium is added to your mortgage amount and paid off over the life of your loan. Book a free appointment with our mortgage brokers on 1300 266 266 Sydney wide or for a telephone appointment today. You can still get a mortgage if you are self-employed - youll just have a few more hoops to jump through than if you were a full-time employee.

How to work with a broker to get a better home loan deal. Compare the cost of switching your mortgage. Find out if youre eligible for reduced.

You can adjust the variables within the calculator. This calculator helps you work out the most you could borrow from the bank to buy your new home. Use a mortgage borrowing calculator.

Self Employed Mortgage Requirements Assure That You Qualify Mortgage Tips Mortgage Self

Find Out 3 Ways To Buy A House Without A Mortgage Loan In 2021 Mortgage Mortgage Loans Home Buying

Vacation Request Form Template Business Template Return To Work Writing About Yourself

Mortgage Payment Rate Calculators True North Mortgage

Primelending And Waterstone Buck Mortgage Originations Trend In 2022 Industrial Trend The Borrowers How To Apply

Ez Mortgage Payment Table

Self Employed Mortgage Calculator Haysto

Self Employed Mortgage Calculator Haysto

Personal Loan Company In West Bengal Loan Company Personal Loans Financial Organization

Mortgage Affordability Calculator 2022

Simple Loan Application Form Template Beautiful Personal Loans Calculator India Quick And Easy Cash Contract Template Letter Templates Personal Loans

Here S A Quick Guide To Knowing The Magic Of Compound Interest In 2022 Compound Interest Simple Interest Loan Calculator

Mortgage Calculator Hardbacon

Types Of Mortgage Refinancing Programs Refinance Mortgage Refinancing Mortgage Home Refinance

Attention Home Buyers Stop Renting Start Investing How Much Rent Did You Pay In The Last Few Years Why Pay Your La Mortgage Brokers Mortgage Home Inspector

Residential Construction Budget Template Excel Inspirational 15 Bud Spreadsheet Exc Household Budget Template Budget Planner Template Budget Template Printable

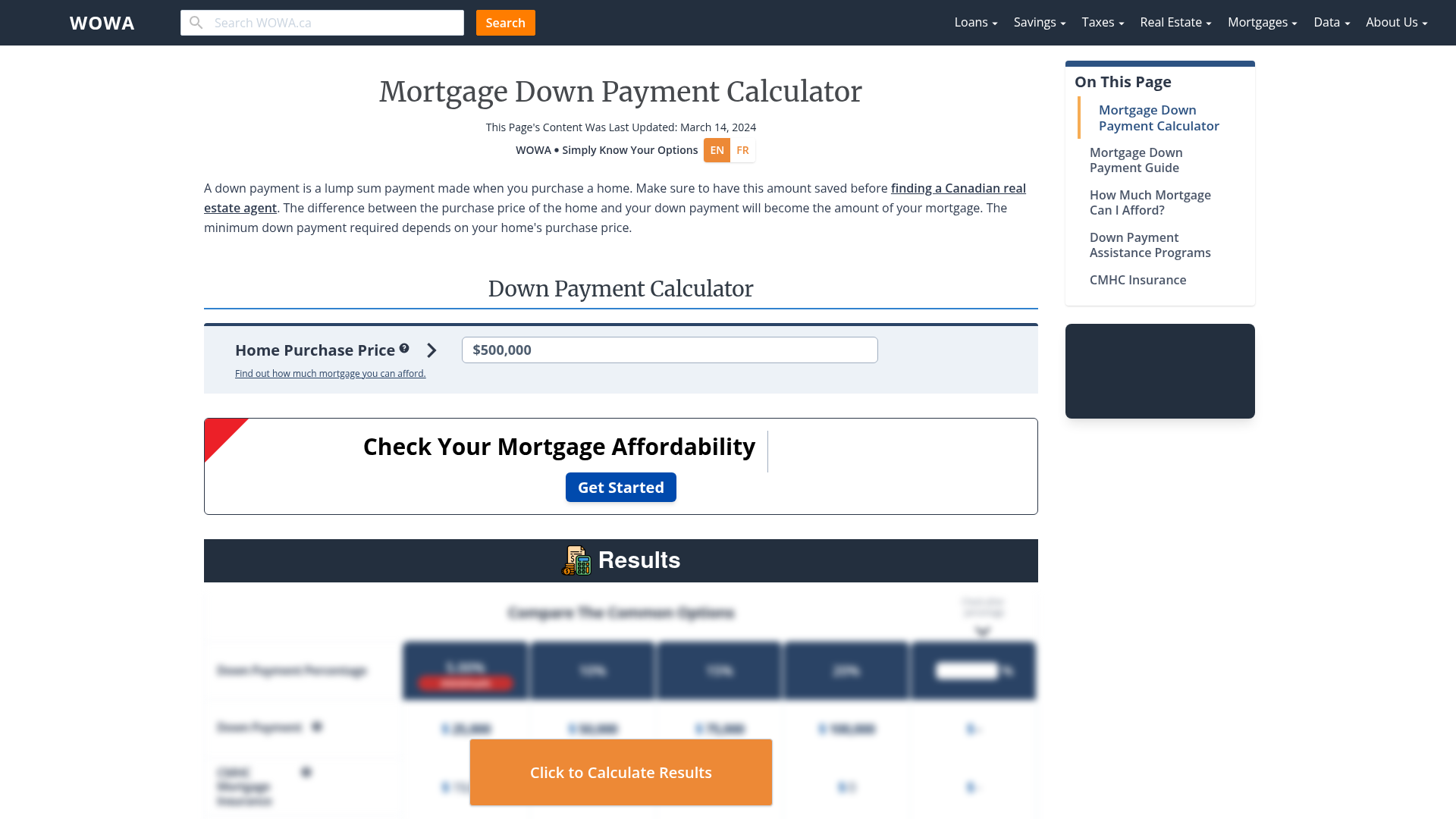

Mortgage Down Payment Calculator 2022 Mortgage Rules Wowa Ca